I agree to and consent to receive news, updates, and other communications by way of commercial electronic messages (including email) from Quadro Resources. I understand I may withdraw consent at any time by clicking the unsubscribe link contained in all emails from Quadro Resources.

Quadro Options Its Staghorn Central Newfoundland Gold Property to TRU Precious Metals Corp.

Vancouver, B.C., June 16, 2022. Quadro Resources Ltd. (“Quadro” or the “Company”) (TSXV: QRO, OTCQB: QDROF, FRA: G4O2) is pleased to announce that, subject to TSX Venture Exchange (the “Exchange”) approval, it has signed an option agreement for the Staghorn property in Newfoundland and Labrador (the “Property”) with TRU Precious Metals Corp. (“TRU”), giving TRU the option to acquire up to an aggregate 65% interest in the Property (the “Staghorn Option”).

THE STAGHORN OPTION

In order for TRU to exercise the Initial Option of 51% interest in the Property, TRU shall make the following payments, shall cause the following shares to be issued and in the name of Quadro (the “Purchase Price”) and shall incur an aggregate of $1,100,000 of exploration expenditures (subject to certain adjustments) (the “Exploration Expenditures”), including at least an aggregate of $660,000 worth of drilling activities on the Property (the “Initial Drilling Commitments”) on or before the corresponding dates set forth below.

The Initial Option:

- On three days following Exchange approval (the “Effective Date”): the issuance of $100,000 in TRU shares, such TRU shares to have a deemed issue price per TRU share equal to the greater of: (a) the VWAP of the TRU shares (VWAP meaning the volume-weighted average trading price of the TRU shares on the Exchange for the twenty previous consecutive trading days); and (b) the lowest discounted price permitted pursuant to the policies of the Exchange;

- On or before the one year anniversary of the Effective Date: (i) the payment of $25,000 in cash; and (ii) the issuance of a further $100,000 in TRU shares, such TRU shares to have a deemed issue price per TRU share equal to the greater of: (a) the VWAP of the TRU shares; and (b) the lowest discounted price permitted pursuant to the policies of the Exchange; and (iii) incur Exploration Expenditures of an aggregate of $200,000;

- On or before the two year anniversary of the Effective Date: (i) a further payment of $100,000 in cash; (ii) the issuance of a further $150,000 in TRU shares, such TRU shares to have a deemed issue price per TRU share equal to the greater of: (a) the VWAP of the TRU shares; and (b) the lowest discounted price permitted pursuant to the policies of the Exchange; and (iii) incur Exploration Expenditures of an aggregate of a further $300,000; and

- On or before the three year anniversary of the Effective Date, incur Exploration Expenditures of an aggregate of a further $600,000.

On the Effective Date, the parties shall form an exploration committee to review upcoming exploration programs to be conducted and objectives to be accomplished with respect to the Property. Under the terms of the Option Agreement, TRU shall be the with overall responsibility for the exploration operations on the Property.

The Additional Option:

Upon acquiring the 51% Interest in the Property pursuant to the exercise of the Initial Option, the Optionee may exercise the Additional Option and acquire the additional 14% Interest by: (i) providing the Optionor with written notice of its intention to exercise the Additional Option within 30 days of exercising the Initial Option; (ii) making a payment of $200,000 in cash to the Optionor within 45 days of exercising the Initial Option; (iii) issuing to the Optionor (or as the Optionor may otherwise direct) within 45 days of exercising the Initial Option $250,000 in Shares, such Shares to have a deemed issue price per Share equal to the greater of: (a) the VWAP of the Shares; and (b) the lowest discounted price permitted pursuant to the policies of the Exchange; and (iv) incurring an additional $850,000 of Exploration Expenditures, within two years of exercising the Initial Option.

Upon the Optionee acquiring the 51% Interest in the Property and failing to exercise the Additional Option, or the 65% Interest in the Property, as the case may be, the Parties hereby agree to enter into a joint venture agreement (the “JVA”), such JVA to contain normal industry standard terms for transactions of this nature, to be agreed upon by the Parties, each acting reasonably, and shall provide, inter alia: (i) the intended scope and business of the joint venture; (ii) the participating Interests of the Parties, with the Optionee holding a 51% Interest in the Property and the Optionor holding a 49% Interest in the Property if only the Initial Option is exercised or with the Optionee holding a 65% Interest in the Property and the Optionor holding a 35% Interest in the Property if the Additional Option is exercised; (iii) a management committee to determine the overall policies, objectives, budgets, procedures, methods and actions with respect to the Property, and such committee shall consist of 3 members: 2 selected by the Optionee, and 1 selected by the Optionor; (iv) the powers and duties of the Operator of the Property; (v) disposition of production (if applicable); (vi) required expenditure commitments and costs, including but not limited to all expenses, obligations and charges incurred in connection with the maintenance, exploration and development of the Property (collectively, the “JVA Costs”); (vii) adjustment and dilution of Interests; (viii) dispute resolution procedures and remedies; and (ix) termination of the JVA.

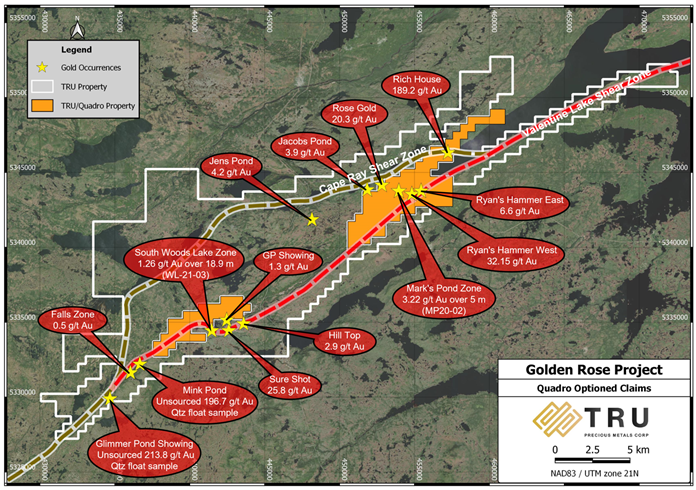

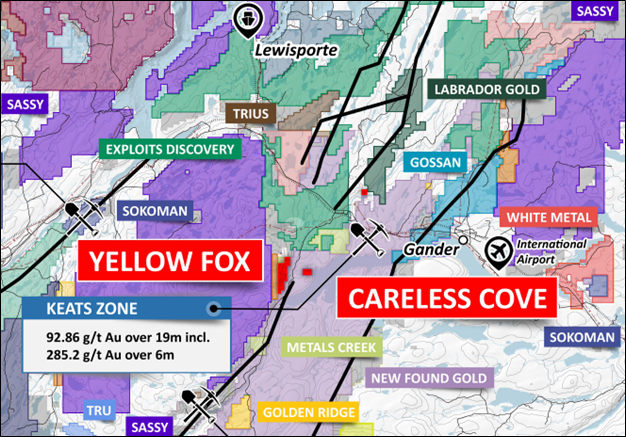

From T. Barry Coughlan (CEO): “We are pleased that TRU has optioned our Staghorn gold property. TRU’s existing claim package of its Golden Rose Project is contiguous to the Staghorn claims and it is therefore a strategic exploration expansion for it to option Staghorn. The Staghorn option agreement will have TRU focused on drilling to earn its option, allowing the Staghorn data package to be strengthened and expanded upon. This will allow Quadro to focus on exploration and drilling at Long Lake and initial exploration work at the Careless Cove/Yellow Fox properties (see Figure 2).

Our exploration and drilling programs to date at Staghorn have shown that the Marks Pond Gold Horizon has been extended to over 600m in strike length and has proven continuity down dip, with the most significant aspect being the recent discovery of a lower zone of high-grade mineralization with visible gold below the main zone. We look forward to developing the Staghorn targets together with TRU, through additional drilling to follow up on the high-grade lower zone and wide step out drilling on the Marks Pond Horizon where a number of gold-in-soil anomalies remain to be tested.”

THE STAGHORN PROPERY

Quadro is focused on the gold rich Cape Ray Fault system, described as one of the most prospective but underexplored regions in Canada. Located in west-central Newfoundland, the Staghorn property as well as the Long Lake property cover portions of the auriferous Cape Ray Fault system which hosts a number of active gold exploration programs including Marathon Gold’s Valentine Lake deposits (Proven Mineral Reserves of 1.40 Moz (29.68 Mt at 1.46 g/t) and Probable Mineral Reserves of 0.65 Moz (17.38 Mt at 1.17 g/t). Total Measured Mineral Resources (inclusive of the Mineral Reserves) comprise 1.92 Moz (32.59 Mt at 1.83 g/t) with Indicated Mineral Resources (inclusive of the Mineral Reserves) of 1.22 Moz (24.07 Mt at 1.57 g/t). Additional Inferred Mineral Resources are 1.64 Moz (29.59 Mt at 1.72 g/t Au). “N.I. 43-101 Technical Report & Feasibility Study on the Valentine Gold Project, Newfoundland and Labrador, Canada” prepared by Ausenco Engineering Canada Inc. with an effective date of April 15, 2021). Mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on the Company’s property.

Figure 1: Quadro’s Staghorn project, Newfoundland (courtesy of TRU).

Figure 2: Quadro’s Careless Cove/Yellow Fox properties.

The Marks Pond Gold Horizon has been extended to over 600m in strike length and has proven continuity down dip. The most significant aspect of 2021 was the discovery of a lower zone of high-grade mineralization with visible gold below the main zone. Additional drilling is planned to follow up on the high-grade lower zone and wide step out drilling on the Marks Pond Horizon where a number of gold-in-soil anomalies remain to be tested.

Drilling to date:

- Jul-Oct 2021 – 891 meters in four holes. A high of 29.1 g/t Au over 0.35 m within a 57.0 m wide zone grading 0.33 g/t Au and 1st definitive visible gold, below the main zone; 1.95g/t Au over 6 m; 1.1 g/t Au over 5.0 m including 1.8 g/t Au over 3.0 m, thus extending the Marks Pond Horizon 200 m to the southwest for a total of 626 m strike length.

- Feb-Apr 2021 – 1403 meters in ten holes, all targeted on the Marks Pond gold zone. The drilling consisted of a series of 50-meter spaced step-out and undercut holes to the northeast of the discovery hole MP20-02. Drilled in late 2020, this hole intersected a gold zone assaying 3.22 g/t Au over 5.0 m, within a wider intersection of 1.98 g/t Au over 12.0 m. Another hole intersected 20.37 g/t Au over 0.5 m and 3.89 g/t Au over 2.5 m in undercut drill holes. These holes were revisited for under drilling in Sep-Oct 2021.

- Sep-Dec 2020 – 1696 meters in thirteen holes. The drilling tested two of four soil anomalies in the Marks Pond area and attempted to expand on the Ryan’s Hammer mineralization previously tested in 2018 at Staghorn. The highlight of the program was the discovery of a new gold zone at Mark’s Pond where hole MP20-02 intersected 10.1 g/t over 1.0m within a wider interval of 3.22 g/t Au over 5.0 m.

- Nov-Dec 2018 – 887 meters in five holes focused on completing a fence of holes across the Cape Ray structure at Ryan’s Hammer, Staghorn. This drilling combined with previous drilling to the east partially outlined two wide gold trends with only one drill cut in each trend.

- Nov-Dec 2017 – 1466 meters in nine holes focused on the Woods Lake Zone, Staghorn. This program confirmed the widespread extent of an auriferous altered granodiorite within a flexure of the Cape Ray fault and required additional drilling to better define higher grade zones within the package.

QA/QC PROTOCOL

Quadro has implemented a quality control program on its drill programs at the Staghorn Project to ensure best practice in sampling and analysis. Quadro maintains strict quality assurance/quality control protocols including the systematic insertion of certified standard reference and blank materials into each sample batch. Analyses in this release were performed by Actlabs of Ancaster, ON, with ISO 17025 accreditation. All samples were assayed using industry-standard assay techniques for gold. Gold was analyzed by a standard 30 gram fire assay with an AA finish.

Quadro acknowledges the financial support of the JEA Program, Department of Natural Resources, Government of Newfoundland and Labrador.

QUALIFIED PERSON

Wayne Reid, P. Geo., VP Exploration for Quadro and a qualified person as defined in National Instrument 43-101, is responsible for this release and supervised the preparation of the information forming the basis for this release.

ABOUT QUADRO RESOURCES

Quadro is a publicly traded mineral exploration company. It is led by an experienced and successful management team and is focused on exploring for gold in North America. The Company’s shares trade on the TSX Venture Exchange under the symbol “QRO”. Quadro owns a 100% interest in the Staghorn property, which it has optioned to TRU Precious Metals Corp., has an option to earn a 100% interest in the Long Lake and Careless Cove properties, and has an option to earn an initial 51% interest in the Tulks South Property, in Newfoundland.

On behalf of the board of directors,

Quadro Resources Ltd.

“T. Barry Coughlan”

President and CEO

Tel (604) 644-9561

info@quadroresources.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.